Maximize the Returns of Your Property

by Leveraging Your Equity

We offer Home Equity Lines of Credit for primary residences, second homes, and investment properties. Besides offering lines of credit, we also offer closed-end second mortgages qualifying using traditional income documentation or bank statements to qualify for the loan.

The only service to provide unbiased guidance across every selling model.

Home Equity Lines of Credit

HELOC and HELOAN

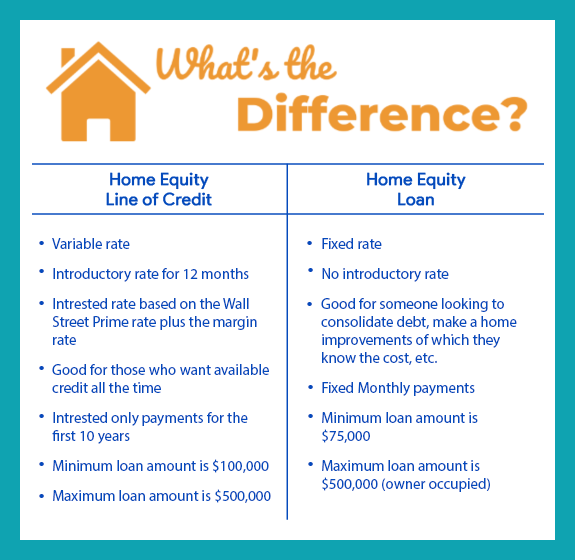

A HELOC (Home Equity Line of Credit) and a HELOAN (Home Equity Loan) are both types of loans that allow homeowners to borrow against the equity in their homes. However, there are some key differences between the two. A HELOC is a revolving line of credit, similar to a credit card, where borrowers can withdraw funds as needed and only pay interest on the amount borrowed. On the other hand, a HELOAN is a lump sum loan where borrowers receive the full amount upfront and make fixed monthly payments, including both principal and interest.

Find out which is the best fit for you

Simple Requirements for a

Home Equity Line of Credit

3 Simple Requirements

Credit Score Over 620

Credit Score Over 620

Some Exceptions

Max DTI 49%

Max DTI 49%

No Income Check Available

Min Loan Amount $75K

Min Loan Amount $75K

Exceptions Allowed

See if You Qualify

Quick form to fill out, get an answer within 1 hour.

No Income Check

Home Equity Line of Credit

For self-employed, unemployed, gig workers, freelancers or those with irregular income streams and at least 60% equity in your property.

Key Requirements

-

Reserves

Reserves -

Min. 700 score

Min. 700 score

HELOC VS HELOAN

A HELOC is a revolving line of credit secured by your home, while a HELOAN is a fixed-rate loan with a lump sum payout. HELOCs offer flexibility, while HELOANs provide stability.

Home Equity Market Insights

How Does a HELOAN Work?

A home equity loan can be a valuable financial tool for homeowners looking to tap into the equity they have built in their homes. First and foremost, it's important to understand what home equity is. Home equity is the difference between the current market value of...

Stand-Alone HELOC Program

HomeEquities.com, a leading mortgage company specializing in home equity lines of credit, is excited to announce the launch of its new Stand-Alone Home Equity Line of Credit (HELOC) Program. This innovative program allows homeowners to tap into their home equity...

Offering HELOCs Nationwide

HomeEquities.com is a leading mortgage company that specializes in providing home equity lines of credit. With a wide range of options and aggressive terms, we aim to help homeowners access equity from their homes. Our program offers various draw options, including 2...

Non-QM Home Equity Products

No Income Program

We offer No Income Check HELOCs. Perfect for self-employed, unemployed, gig workers, or other type of unsourceable income individuals.

Bank Statement Program

We don’t require traditional income docs, we calculate income based on the average of the past 12 month deposits.

DSCR Program

For investment properties, we don’t require any personal income documentation. The property will need to debt service against the rental income of the investment property.